Three and a half years ago, the English publication of Thomas Piketty’s surprise bestseller, Capital in the Twenty-First Century, sparked an international debate about the roots of rising inequality. Today, his publication of new data on inequality makes for equally sobering reading: The gap between rich and poor has increased in nearly every region in the world over the past few decades.

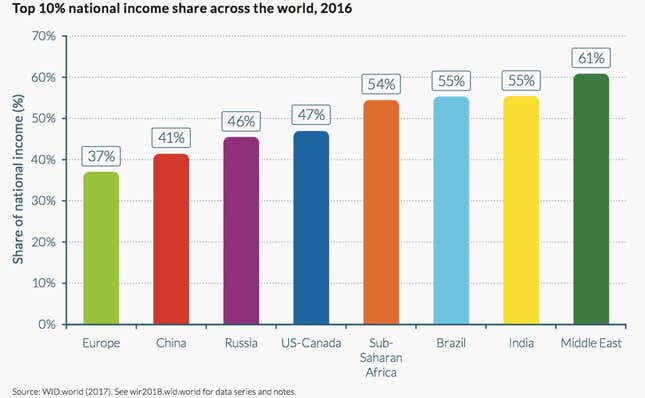

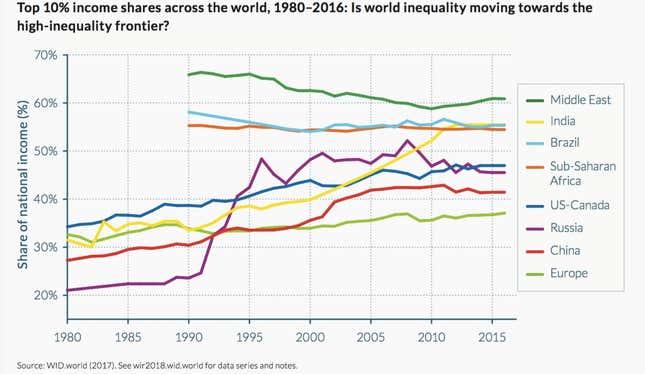

The 300-page World Inequality Report by the World Inequality Lab, based at the Paris School of Economics, shows that, since 1980, income inequality has increased rapidly in North America and Asia, increased more moderately in Europe, and stabilized at very high levels in the Middle East, Africa, and Brazil.

The report, overseen by Piketty and Lucas Chancel, is based on the latest evidence collected for the World Wealth and Income Database, a massive project maintained by more than 100 researchers in more than 70 countries.

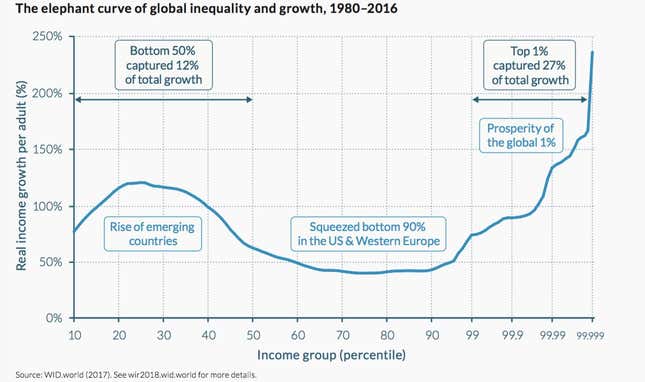

The good news is that the poorest half of the world’s population have experienced significant income growth in recent decades, thanks largely to economic growth in Asia. Still, since 1980 the top 0.1% have captured as much income growth as the entire bottom half of world’s (adult) population. And for the group of people in between the bottom 50% and top 1%—mostly the lower- and middle-income groups in North America and Europe—income growth has been either sluggish or flat. This creates follows a familiar pattern, thanks to the “elephant chart” originally traced by economists Branko Milanovic and Christoph Lakner.

For Piketty, one of the most important aspects of the new report is that it expands data and research on inequality beyond the West. The success of Capital put pressure on governments to provide more information on income and wealth, he says. There’s now a more complete picture of inequality in China, India, Brazil, South Africa, Russia, and the Middle East, though still much more data is required for Africa and the rest of South America. Putting it all together, it suggests that “globalization tends to lead to rising inequality but at very different speeds,” he tells Quartz. That implies that different political institutions and policies lead to very different outcomes.

We hear a lot about rising inequality in the US and Europe, “but in a way, inequality is an even bigger problem in poor and emerging countries,” Piketty says. He points to the differences in China and India. Both countries have experienced rapid economic growth, and with it rising inequality. The income disparity is much worse in India, however. Inequality has stabilized somewhat in China since 2006, suggesting an alternative way to deal with globalization and its effects on inequality, Piketty notes.

There are, of course, limitations to the data. Piketty has previously criticized the Indian government for halting the publication of income tax data for a decade and a half; the numbers from it and other countries remains disjointed. In particular, a comprehensive picture of wealth is hard to get because of tax havens. “It’s a paradox of today’s globalized economy that we are supposed to be in the era of big data and transparency, and we see that we still don’t have access to all the data sources we would need,” Piketty says, arguing that there are financial and political forces that have a vested interest in keeping this information secret.

Mind the gap

The report shows a big divergence in the paths of inequality in the US and Europe. In the US, in 1980 the top 1% had 11% of the national income, increasing to 20% in 2016. The bottom 50%, meanwhile, had 21% of income in 1980, which fell to 13% last year. On the other side of the Atlantic, inequality hardly changed. The top 1% in Western Europe went from controlling 10% to about 12% of national income over the same period, while the bottom 50% maintained about 23% of total income over the decades.

In the US, there has been a “dramatic collapse” in the income share of the bottom 50% that isn’t replicated in other advanced economies, the report says, suggesting that policy is to blame. Even though the bottom 50% have got a “modest” post-tax income boost, thanks to some redistribution over the years, this effect was wiped out by rising healthcare spending. The increase of “super wages” for CEOs and the widening gap between high-wage and low-wage firms have worsened inequality. And even as greater female participation in the workforce has helped to some extent, “the glass ceiling remains firmly in place,” the report states. Men make up 85% of the top 1% in labor income.

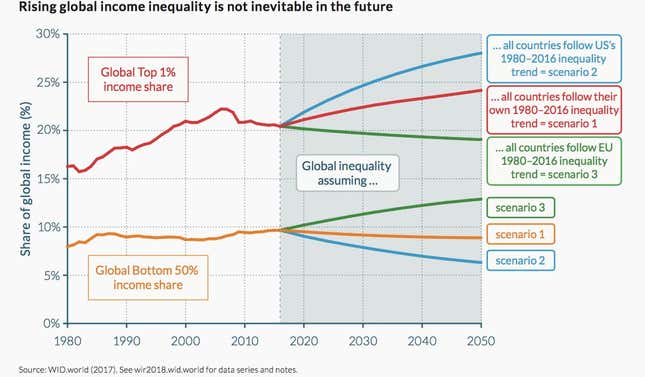

The report then predicts what might happen to global inequality by 2050 in three different scenarios. In the first, the trends of the past three decades extend for the next three, and global inequality increases moderately.

In another, the world follows the trajectory of the US, and inequality gets much worse. The latest efforts to cut taxes will make inequality in America even more severe, Piketty adds. The Lab’s predictions were made before Republican efforts on tax reform, which are focused on deep corporate tax cuts, and which the vast majority of economists believe will be costly and mostly help the rich. “This tax reform is going to exacerbate the trend towards rising inequality,” Piketty says.

However, if the world follows Europe’s path, global inequality will decline, the report says. Still, “there are some areas where Europe is doing worse,” Piketty says, citing competition between countries to cut corporate taxes. “In a way, all that Trump is doing right now regarding corporation taxation is to follow the European lead.”

The French economist argues that within a free trade zone like the EU, there needs to be common taxes on the richest companies and individuals, because they benefit the most from the absence of tariffs. These taxes would provide a communal revenue source to pay for public goods such as infrastructure and education. “You need these public revenues, otherwise globalization and free trade cannot work,” he says. Trade agreements should include a “strong component about fiscal justice,” such as minimum tax rates on corporate profits.

“In that respect Europe is being a bit hypocritical about this, because in a way Europe is the very place where we have built a trade union without any fiscal union, without any minimum tax on corporations in particular, and this has to change,” he concludes.

The report also recommends other policies to reduce inequality, including more progressive taxes, inheritance taxes in the countries where they don’t exist, a global financial register so people can’t hide their wealth in havens, more equal access to education, and improved access to well-paid jobs via minimum wages and better worker representation on decision-making committees.

Overall, the report aims to catch the attention of the general public, politicians, and businesses “so that the growing awareness about rising inequality becomes sufficiently strong to generate action,” Piketty says. Brexit, Donald Trump, rising protectionism, and anti-immigration sentiment are all consequences of rising inequality, he adds. But the economist insists he remains optimistic because he believes there are lots of people in the world who want to be more active in understanding and combating inequality. The report and open-access database are part of an effort to democratize economic knowledge to enable change.